According to RCG’s Global Renewable Infrastructure Projects (GRIP) database, the total capacity financed for offshore wind last year reached 8,370MW across the European, Americas and Asia Pacific (excl. China) regions, eclipsing the previous total of 6,438MW financed in 2018.

According to RCG’s Global Renewable Infrastructure Projects (GRIP) database, the total capacity financed for offshore wind last year reached 8,370MW across the European, Americas and Asia Pacific (excl. China) regions, eclipsing the previous total of 6,438MW financed in 2018.Global investment for offshore wind also set new highs last year as investment reached USD 30 billion, surpassing the previous high of USD 22 billion set in 2018.

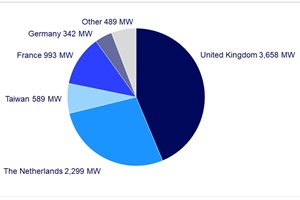

The UK saw more than 3,658 MW in capacity secure investment with 2,950 MW supported by the contracts for difference (CFD) mechanism. In the Netherlands, the centrally planned and developed Hollandse Kust Zuid and Hollandse Kust Noord sites were advanced through the subsidy-free tendering mechanism allocating a combined 2,299 MW in capacity.

In Taiwan, the Changfang and Xaido projects reached final investment decisions (FID) having signed power purchase agreements (PPAs) with an associated feed-in-tariff (FiT) as part of the Zonal Application planning process, allowing 589 MW to move to the pre-construction phase.

In France, the Saint Brieuc and Fecamp projects both reached FID after being awarded FiTs in 2018 (after revisions to the FiT rates previously awarded in 2012). In Germany, Innogy (as part of RWE Renewables) committed to the Kaskasi 2 project in April, after winning the second interim tender for offshore wind in Germany.

China’s offshore wind market – which is slated to surpass the UK as the leading global market in operational capacity by the end of this year – experienced unprecedented growth and project deployment last year. China’s offshore wind market – which is slated to surpass the UK as the leading global market in operational capacity by the end of this year – experienced unprecedented growth and project deployment last year.

Comprehensive project detail for offshore wind farms in China has been added to RCG’s proprietary GRIP database in 2020. Despite signs that China is gradually opening up to international developers and supply chain players, the market remains very isolationist and project details are not made public in a structured format that reciprocates development phases of offshore wind markets in Europe, the Americas and elsewhere in the APAC region.