Global commissioning of wind turbines was up 22% in 2019, thanks to a bumper year in China and the U.S., and an acceleration offshore. A further 24% jump, to 75GW, is expected in 2020. Developers commissioned almost 61GW of wind turbines globally in 2019, compared with 50GW in the previous year. Most of these were on land (88%) but the share of turbines installed offshore is growing, up four percentage points to 12%. Just four manufacturers accounted for more than half, or 55%, of the machines deployed: Denmark’s Vestas, Spain’s Siemens Gamesa, China’s Goldwind, and General Electric of the U.S.

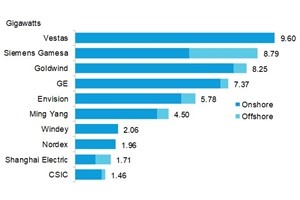

Global commissioning of wind turbines was up 22% in 2019, thanks to a bumper year in China and the U.S., and an acceleration offshore. A further 24% jump, to 75GW, is expected in 2020. Developers commissioned almost 61GW of wind turbines globally in 2019, compared with 50GW in the previous year. Most of these were on land (88%) but the share of turbines installed offshore is growing, up four percentage points to 12%. Just four manufacturers accounted for more than half, or 55%, of the machines deployed: Denmark’s Vestas, Spain’s Siemens Gamesa, China’s Goldwind, and General Electric of the U.S.The latest data from BloombergNEF (BNEF) show that Vestas kept its crown as the world’s leading turbine maker. A busy year offshore propelled Siemens Gamesa to second place, up from fourth.

Of the top 10 onshore turbine makers, Vestas suffered the biggest slippage in its market share, down four percentage points to 18%, as its competitors gained ground. The top five remains unchanged, but in the chasing group, a strong year for Chinese installations pushed up Ming Yang, Windey and Dongfang Electric to sixth, seventh and ninth, respectively.

Nearly half of all new megawatts installed in the U.S. were from GE, enabling it to seize the top spot in its home market from Vestas. GE outperformed its rival by commissioning 40% more than it had in 2018, while Vestas’ installation total was stable. Siemens Gamesa enjoyed the biggest bounce of any of the players in the U.S., tripling its 2018 numbers and taking over the third place from Nordex.

Weaker activity in specific markets hit some firms. Enercon and Senvion saw commissioned capacity plummet as Germany’s onshore wind market collapsed due to a shortage of available sites, litigation and drawn-out lead times for projects. Suzlon suffered a similar fate in India, where project execution challenges resulted in installations falling short of expectations.

Total onshore wind additions in 2019 were 13.3GW in the Americas, 9GW in Europe and 0.5MW in Africa and the Middle East, while Asia Pacific accounted for 30.4GW. BNEF’s database registered new wind farms starting full commercial operations in 43 countries.

Siemens Gamesa’s offshore installations in European waters blew its competition away. The company retains the number one position in the offshore wind market after more than doubling its installations compared with 2018. MHI Vestas capacity is not attributed to Vestas – organisations must own more than 50% of a subsidiary to receive credit.