As global markets fluctuate in terms of capacity additions on an annual basis, and auctions/tenders threaten wind turbine OEM profitability, a few manufacturers have taken steps to ensure their survival. These steps involve a diversity of product mix and a modular product architecture which will allow them to more evenly distribute their global manufacturing while maximising supply chain cost efficiencies and also providing a mechanism for global sales.

As global markets fluctuate in terms of capacity additions on an annual basis, and auctions/tenders threaten wind turbine OEM profitability, a few manufacturers have taken steps to ensure their survival. These steps involve a diversity of product mix and a modular product architecture which will allow them to more evenly distribute their global manufacturing while maximising supply chain cost efficiencies and also providing a mechanism for global sales.The wind turbine manufacturing companies who have invested in a more modular architecture tend to be able to stretch their product portfolio with multiple power ratings on the same rotor, which improves the return on capital. This approach also optimises the product offerings for sale in every market to ensure OEMs get the best payback on their R&D and manufacturing capital investments.

Essentially, a modular turbine architecture utilises blades, towers, generators, converters, gearboxes (if applicable) with as many of the same subcomponents as possible. Making turbines with multiple power ratings, rotor sizes and hub heights with as much commonality of gears, bearings, IGBTs, etc. enables OEMs to:

- increase subcomponent order volume, which decreases per unit cost;

- improve availability of spares, which decreases O&M cost;

- enable a diversified geographic manufacturing of components based on lowest capex and an optimised minimum logistics cost.

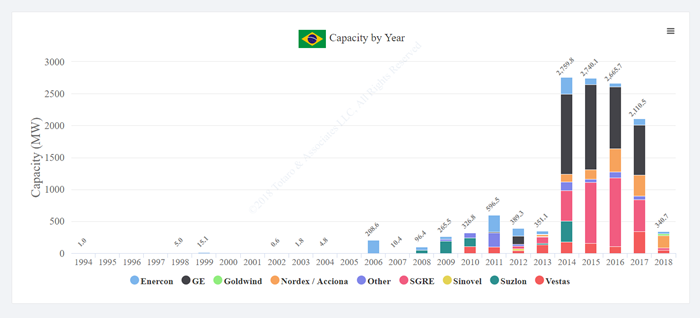

This architectural design approach can also help offset the adverse impacts of markets with anticipated drops in annual capacity. One good example is the recent market situation in Brazil.

Enercon has recently invested in a more modular wind turbine architecture to optimise its supply chain. However, its design philosophy must still be brought to markets where it can competitively sell. Looking at its product portfolio, the E-126 4.2MW, E-141 4.2MW, and E-115 3.0MW need to be pushed harder in Brazil to take advantage of the available wind resource while simultaneously outmanoeuvring its competition in under-penetrated market segments. The other consideration is whether it has the necessary capital for the blade and generator tooling.

GE has a slightly different take on the modular component design philosophy with a multitude of rotor sizes and power rating options which allow for the consistent use of an 80-metre hub height. Its 2.X-116 and 1.X-100/103 product ranges have sold well in the past. Now, as the market shifts towards higher hub heights, the product range evolution offered in the market will also evolve to the 3.X-130 and 3.X-137, as well as the possibility of the 2.5-127. Anticipating it will not have the manufacturing tooling for all its products for Brazil, GE will likely continue to target the lower end of the IEC wind speed class / power density range of approximately 170–300W/m2. This scenario puts GE at a potential commercial disadvantage in Brazil moving forward despite its current market-leading position. As other OEMs now offer competing products in the same power density ranges as GE’s core products, this will necessitate a focus on products which can optimise the levelised cost of energy.

Other products outside the default power density range might still compete, but these competitor products will have to make up for deficits in AEP with significant price pressure on the capex cost of the turbines in a competitive tender.

The combination of products from Siemens Wind Power and Gamesa at the new Siemens Gamesa Renewable Energy has led to a fairly robust product portfolio, but often with fewer options to offer in most markets versus GE or Vestas. Brazil being no exception, the G97 and G114 will continue to see tremendous impact, but the G126 and G132 have yet to see significant order commitments.

As with GE, the limitations in manufacturing tooling could preclude these products from seeing a robust rollout thanks to the local content regulations in Brazil. These regulations which necessitate domestic manufacturing to qualify for BNDES financing have led several OEMs to only develop Brazilian market specific products and the corresponding manufacturing tooling.

Vestas has a robust product portfolio, and it was one of the first movers to use a modular product architecture, but it is similarly hampered by the lack of manufacturing tooling in place in Brazil to support its ambitions in the domestic market, as well as its ability to use it as an export hub for other markets in the region.

The Brazilian market customised versions of the V100 and V110 products have predominantly been sold in that domestic market in the past 3–4 years. In the meantime, Vestas has lacked the manufacturing tooling for the V117, V126, V136 and V150 products, but it is anticipated that these products will be manufactured and sold in Brazil and other South American markets by 2020.

The shift towards a common platform architecture and wind turbine products which are designed for global markets will open up more export market opportunities. However, it is necessary to make a more intelligent investment in the manufacturing tooling for these modular designed products so that OEMs can take advantage of both domestic markets and exports.

This export market exploitation also protects against regional fluctuations in demand and provides an offset to currency depreciation. The ability of wind turbine OEMs to consistently deliver a product mix which can succeed in all markets will be critical to future success and profitability.