Looking at the levelised cost of energy (LCOE) equation, the offshore wind industry has a unique and timely opportunity to achieve maximum impact by driving innovation and technology development towards lower CapEx and OpEx costs, and increased annual energy production (AEP).

Looking at the levelised cost of energy (LCOE) equation, the offshore wind industry has a unique and timely opportunity to achieve maximum impact by driving innovation and technology development towards lower CapEx and OpEx costs, and increased annual energy production (AEP).

By Philip Totaro, Founder & CEO IntelStor, LLC

Investments in some specific technologies will result in maximum gains as the offshore wind industry peers at an increasingly cost-sensitive market, where subsidy-free competitive markets may become more frequent.

A comprehensive evaluation of over 1,000 innovations that are offshore-wind-specific, as well as over 13,000 innovations that are general to wind technology and could represent dual-use in the offshore wind sector, points towards three innovations that are likely to have the greatest impact.

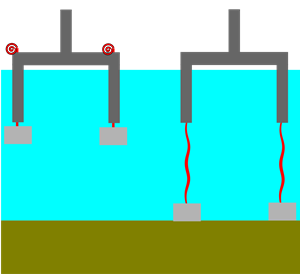

- Tension leg platforms (TLPs) can accommodate almost any water depth, and offer the ability for turbine erection quayside, then tow-out for commissioning. This technique provides a more controlled environment than a vessel-based approach, and can reduce installation and commissioning times to a minimum level. TLPs appear to be the ultimate offshore wind foundation technology, and offer the best scalability, satisfying three of our top 30 criteria for future offshore wind technologies.

- Predictive maintenance scheduling, as part of an overall condition-based maintenance regime, will have a significant impact on OpEx cost reduction. A cost reduction of up to 37% compared with 2016 average offshore wind OpEx could be seen with the implementation of this technology.

- Just as with onshore technology, energy output optimisation can have a profound impact on increasing AEP and improving LCOE. This will be governed by complex algorithms which can balance optimising power delivery to the grid for maximum revenue against ‘banking’ excess power beyond the power purchase agreement obligations in an energy storage system and time-shifting for more favourable market pricing. In the past 27 years, there have been only a few innovations focused on AEP enhancement in offshore wind other than new turbine models with increased capacity. This newly developed technology represents an opportunity to provide substantial LCOE improvement, and it can be leveraged in both onshore and offshore wind environments.

Installation costs have also been considered disproportionately high in the past few years, leading to exorbitant margins for installation and commissioning schedules which are being met and exceeded regularly nowadays as new vessels are brought on-line and best practices from years of learning are put into practice. The TLP technology development should reconcile these recent challenges and obviate the need for such a significant schedule margin.

The financial considerations of LCOE improvement will remain out of scope for the moment, but it is noteworthy that improving component reliability and de-risking installation challenges will reduce weighted average cost of capital as project execution risk and installation uncertainties can be reduced.

While each technology has its own commercialisation path, some of the highest impact technologies are under active development, and could be available to the market by 2025.

Historically, the industry has seen an influx of innovation on foundation technologies, and while they have a place in CapEx reduction the majority of foundation innovations proposed will never see the commercial market due to lack of funding and no path away from their current low technology readiness level (TRL).

Evaluating the TRLs of all the offshore wind components, we can see a trend towards a few commercial adoptions (TRL 9), but the bulk of ideas lying at a much lower TRL level between 3 and 5.

A gap at TRL 6 should come as no surprise, as it represents a key decision point for both funding and commercial decisions on technology adoption and investment of R&D for demonstration purposes. A significant amount of innovations at TRL 7 is also no surprise, as many go through a rigorous design and testing phase only to uncover a lack of commercial potential, leading to abandonment of the idea and corresponding intellectual property.

The timing of technology development has seen a significant increase in recent years, with a significant uptick in the past seven years after a slow start back in 1990. Nevertheless, it is noteworthy that most of the technology in offshore wind is still at a relatively low maturity level, and even innovations from many years ago are not yet seeing the necessary investment in proof of concept and field testing.