In the 1980s, the three-bladed, fixed speed Danish wind turbine was the dominant model with a rated capacity of less than 200kW. Forty years later, wind turbine manufacturers are continually breaking the proverbial glass ceiling by launching turbines bigger than we would ever have imagined just a few decades ago. In May 2020, Siemens Gamesa Renewable Energy launched the biggest turbine ever announced, clocking in at 14MW and with a 222-metre rotor diameter for offshore wind farms. Just one of these turbines could generate enough electricity to power 18,000 European households every year.

In the 1980s, the three-bladed, fixed speed Danish wind turbine was the dominant model with a rated capacity of less than 200kW. Forty years later, wind turbine manufacturers are continually breaking the proverbial glass ceiling by launching turbines bigger than we would ever have imagined just a few decades ago. In May 2020, Siemens Gamesa Renewable Energy launched the biggest turbine ever announced, clocking in at 14MW and with a 222-metre rotor diameter for offshore wind farms. Just one of these turbines could generate enough electricity to power 18,000 European households every year.By Feng Zhao, Strategy Director at Global Wind Energy Council

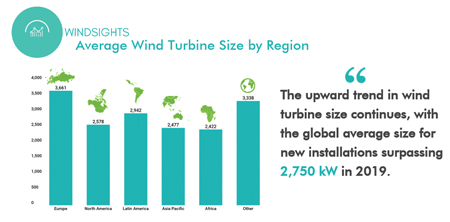

According to the Global Wind Energy Council’s (GWEC’s) new ‘Supply Side Data 2019’ report, this upward trend in wind turbine sizes has been rapidly accelerating. In the past decade alone, the average turbine size has grown by around 72%, with an average size in 2019 of 2.75MW. This significant increase can be attributed to both the innovation leadership in the wind industry as well as the surge in the offshore wind market, which can use much bigger turbines than those installed onshore.

Of the 22,893 wind turbines installed in 2019, around 52% were in the size range 2 to 2.99MW, making turbines of this size the most dominant models in 2019. Yet bigger models are not far behind, with turbines of 3 to 3.99MW accounting for almost 28% of the market share in 2019, an increase of 5% compared with the previous year. In fact, turbines of this size made up more than 60% of new installations from major turbine OEMs Vestas, Mingyang, Nordex Acciona and Senvion.

More mature wind markets typically boast bigger turbines, with Europe a clear leader with an average size of around 3.67MW. Yet turbines in India, the fourth-largest wind market in the world, remain relatively small at an average size of 2.2MW, which is smaller than the average size in emerging wind markets in Africa.

Denmark, one of the world’s top offshore markets, recorded the largest average turbine size in 2019 at 7.79MW – over 2MW more than the second place UK. However, both the UK and Denmark became the first group of countries to pass the 5.0MW milestone in 2019, an impressive feat which should not be undersold.

We are not only seeing a shift in the size of turbines but also the turbine technology used. The conventional high-speed geared system, used in the turbines manufactured by OEMs such as Vestas, GE Renewable Energy, SGRE, Envision, and Nordex Acciona, has been the mainstay of wind turbine technology since the industry’s early days, but it saw a slight decline in market share in 2019 to 67.6%. Hybrid-drive wind turbines (otherwise known as medium-speed turbines) increased by 3.1% in the same year, primarily due to its two primary contributors, Mingyang and MHI Vestas, increasing their respective installations in 2019.

At the other end of the spectrum, direct-drive (DD) turbines lost 1% of their market share in 2019 despite permanent magnet generator (PMG) DD turbines actually increasing to 22.6%. The major driver of this technology type is Goldwind, installing around 58% of all PMG DD turbines in 2019.

Overall, it is clear that wind turbine technology is rapidly evolving as the market becomes more competitive and OEMs must innovate to maintain their market position. Although bigger does not always mean better, larger turbines do help lower the levelised cost of electricity and open up new market opportunities for the wind industry. Not only this, larger turbines help capacity to be deployed quicker, which is crucial if the wind power capacity needed before 2030 is to be installed to meet our Paris Agreement goals.

Finally, I would like to leave you with an image to give you an idea of just how far the industry has come. In 2019, 22,893 turbines were installed to deliver over 63GW of capacity. To reach the same capacity level using the most popular 200kW model in the 1980s, we would need 315,380 turbines – nearly 14 times the number of turbines.

This rapid development is nothing short of impressive, and we only see this trend continuing in the future as the wind industry grows and powers a clean energy future.

The full report ‘Supply Side Data 2019’ is exclusively available to GWEC members on the GWEC Market Intelligence Platform.