The operations and maintenance market in the wind energy sector will likely see cost increases through the next 5 – 7 years as full wrap service contacts become more common, and more lucrative for wind turbine OEMs according to IntelStor. Since 2010, the average cost of a maintenance contract has increased 20.9%, driven by higher than expected maintenance costs for ageing assets, along with a more robust scope of service.

The operations and maintenance market in the wind energy sector will likely see cost increases through the next 5 – 7 years as full wrap service contacts become more common, and more lucrative for wind turbine OEMs according to IntelStor. Since 2010, the average cost of a maintenance contract has increased 20.9%, driven by higher than expected maintenance costs for ageing assets, along with a more robust scope of service.Long term service contracts inclusive of full replacement of components in the event of a catastrophic failure on parts such as gearboxes, generators and electrical systems in addition to blades (often referred to as “full wrap”) have resulted in higher rates.

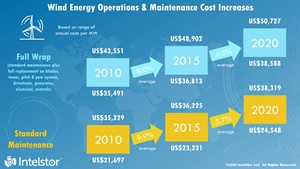

The capacity weighted average cost of standard maintenance has increased from $28,746.21 per installed MW for projects which went COD (commercial operation date) in 2010 to $34,213.38 per installed MW for projects which we expect will be COD in 2020. Similarly, the capacity weighted average cost of full wrap maintenance contracts has increased from $39,049.14 per installed MW for projects which went COD in 2010 to $44,455.09 per installed MW for projects which we expect will be COD in 2020.

The high end of the range of standard maintenance costs is now more expensive than the low end of the range for a full wrap agreement for wind energy projects which went COD just five years ago. We are predicting that by 2025, the high end of the range for standard maintenance contracts will exceed the cost of the most expensive full wrap agreements for projects which went COD in 2010. Full wrap agreement costs could see another 3 – 5% increase at a minimum in the next five years as well.

There are two key drivers of these increasing operations and maintenance costs. The first is wind turbine OEMs are still using a lower turbine price as leverage in their commercial negotiations to obtain more favorable rates on their long-term service contracts. Declining wind turbine prices are resulting in wind turbine OEMs sacrificing margin on turbine supply contracts in order to sign more expensive full wrap contracts in an effort to claw back their margin. While this strategy implies a risk to the OEMs, with operational performance of the asset at 98 – 99% availability with minimal major corrective repairs should allow them to take a net positive return over the lifetime of the project.

The second driver for escalating O&M costs are that technologies like data analytics are not yet seeing a material impact on overall cost. The opportunity to reduce OpEx cost is almost completely missed at this stage due to a cost shift from reactive maintenance practices to predictive maintenance practices powered by data analytics.