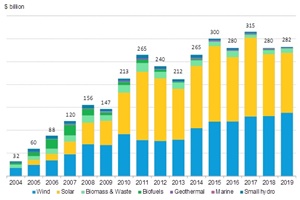

Investment in renewable energy capacity worldwide was $282.2 billion last year, up 1% from 2018’s $280.2 billion, with the world’s biggest market (China) slipping back, but its second-largest (the U.S.) hitting a new record according to the latest data from research company BloombergNEF (BNEF).

Investment in renewable energy capacity worldwide was $282.2 billion last year, up 1% from 2018’s $280.2 billion, with the world’s biggest market (China) slipping back, but its second-largest (the U.S.) hitting a new record according to the latest data from research company BloombergNEF (BNEF).The late surge in offshore wind financings took capacity investment in that sector to $29.9 billion, up 19% on 2018 and $2 billion more than in the previous record year of 2016. Among the offshore projects reaching financial close in the fourth quarter were the 432MW Neart na Gaoithe array off the Scottish coast at $3.4 billion, the 376MW Formosa II Miaoli project off Taiwan at $2 billion and the 500MW Fuzhou Changle C installation in the East China Sea, at $1.5 billion. The first of France’s offshore wind projects to be financed, the 480MW, $2.5 billion Saint Nazaire, got its go-ahead in the third quarter.

Looking at the overall renewable energy capacity investment figures for 2019, wind (onshore and offshore) led the way with $138.2 billion globally, up 6%. Solar was close behind, at $131.1 billion, down 3%. Falling capital costs in wind and solar meant that the two combined are likely to have seen around 180 gigawatts added last year, up some 20GW on 2018.

Among the smaller sectors, biomass and waste-to-energy saw $9.7 billion of capacity investment in 2019, up 9%. Geothermal languished on $1 billion, down 56%. Biofuels were down 43% at an estimated $500 million, and small hydro 3% lower at $1.7 billion.

China was yet again the biggest investor in renewables, at $83.4 billion in 2019, but this was 8% down on 2018 and the lowest since 2013. It saw a 10% rise in wind investment to $55 billion, but solar fell 33% to $25.7 billion, less than a third of the boom figure reached in 2017.

The U.S. was the second-largest investing country in renewable energy capacity, at $55.5 billion, up 28% on 2018. Instrumental in this was a rush by wind and solar developers to qualify for federal tax credits that were due for scale-back in 2020.

Europe slipped behind the U.S. in 2019, investing $54.3 billion in renewables capacity, down 7%. Spain led the way with $8.4 billion, up 25% on 2018 and the highest annual figure for that country since 2011.

The U.K. invested $5.3 billion, down 40% and its lowest since 2007. Germany was down 30% at $4.4 billion, its lowest since 2004, and Sweden was down 19% at $3.7 billion, but the Netherlands were up 25% at $5.5 billion, France 3% higher at $4.4 billion, and Ukraine 56% up at $3.4 billion.

Japan invested $16.5 billion in renewable capacity, mainly solar, in 2019, down 10%, while Australia committed $5.6 billion, down 40%. India put $9.3 billion into green energy, 14% less than in 2018, while the United Arab Emirates invested a record $4.5 billion – almost all of it for the 950MW Al Maktoum IV solar thermal and photovoltaic complex in Dubai.

In Latin America, Brazil lifted renewable energy capacity investment by 74% to $6.5 billion last year, while Mexico committed $4.3 billion, up 17%, and Chile $4.9 billion, up fourfold, and Argentina $2 billion, down 18%.