In 2018, 11 manufacturers installed 735 units of offshore wind turbines globally, totalling 3,693MW of capacity. Six out of the top ten suppliers are from China: Shanghai Electric, Envision, Goldwind, Mingyang, United Power and XEMC. While China is certainly dominant in terms of supplying offshore turbines, it is still playing catch-up in terms of offshore turbine technology.

In 2018, 11 manufacturers installed 735 units of offshore wind turbines globally, totalling 3,693MW of capacity. Six out of the top ten suppliers are from China: Shanghai Electric, Envision, Goldwind, Mingyang, United Power and XEMC. While China is certainly dominant in terms of supplying offshore turbines, it is still playing catch-up in terms of offshore turbine technology.By Feng Zhao, Strategy Director, Global Wind Energy Council

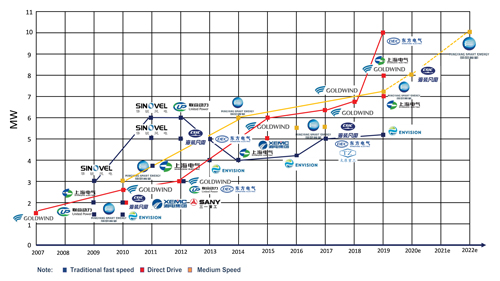

The average wind turbine size in the global offshore wind market was below 5MW before 2017, with no major differences between Europe and China from 2010 to 2016. However, the situation changed after 2017 when the average size of commercial offshore wind turbines installed in Europe surpassed 5MW. The trend of installing larger-scale offshore wind turbines continues in Europe, primarily driven by pressure to reduce the levelised cost of electricity (LCOE). In 2018, the average size of installed offshore wind turbines passed 7MW in Europe, with the Global Wind Energy Council (GWEC) Market Intelligence’s forecast predicting that it could reach as high as 8MW in 2020 and around 10MW in 2023.

Yet, the average annual offshore wind turbine size in China was still below 4MW in 2018. However, this is expected to change. Driven by the same pressure to reduce LCOE, six Chinese turbine manufacturers have introduced large offshore models in the past 12 months, of which only one model is below 6MW. Surprisingly, a 10MW permanent magnet generator also rolled off the production line at Dongfang Electric in August 2019 and the turbine assembly was completed shortly after in its facility in Fujian province, becoming the second largest direct drive offshore wind turbine prototype in the world.

Although the traditional fast speed wind turbine continues to dominate the Chinese offshore wind market, making up 70% of the market share in 2018, China is once again following in Europe’s footsteps with direct-drive and medium speed drive trains increasingly becoming the mainstream technology solution. Out of the six Chinese turbine OEMs that introduced new models in 2019, Envision is the only one still pursuing the fast speed drive-train solution, while other companies such as CSIC Haizhuang and Dongfang Electric have switched to medium speed and direct-drive solutions, respectively. Once Shanghai Electric, China’s number one supplier in offshore wind technology, replaces its best seller 4MW fast speed gear-drive model with its new 6 to 8MW direct-drive technology licensed by Siemens Gamesa Renewable Energy, GWEC Market Intelligence believes that the market share of traditional fast speed offshore turbines will drop to 30% in China.

Although the traditional fast speed wind turbine continues to dominate the Chinese offshore wind market, making up 70% of the market share in 2018, China is once again following in Europe’s footsteps with direct-drive and medium speed drive trains increasingly becoming the mainstream technology solution. Out of the six Chinese turbine OEMs that introduced new models in 2019, Envision is the only one still pursuing the fast speed drive-train solution, while other companies such as CSIC Haizhuang and Dongfang Electric have switched to medium speed and direct-drive solutions, respectively. Once Shanghai Electric, China’s number one supplier in offshore wind technology, replaces its best seller 4MW fast speed gear-drive model with its new 6 to 8MW direct-drive technology licensed by Siemens Gamesa Renewable Energy, GWEC Market Intelligence believes that the market share of traditional fast speed offshore turbines will drop to 30% in China.Taking into account the nameplate capacity of the turbines selected for projects currently under construction in China as well as the announced commercial date for those large offshore turbine models, GWEC Market Intelligence believes that the annual average turbine size in China has the potential to pass 5MW in 2020 and 7MW in 2025.