The global offshore wind energy market appears poised for significant growth in the coming years, driven by demand as well as cost reductions in new technology. IntelStor has previously predicted a global offshore wind market of 355GW by 2050, up significantly from the current levels of ~49GW expected to be installed globally by the end of 2019.

The global offshore wind energy market appears poised for significant growth in the coming years, driven by demand as well as cost reductions in new technology. IntelStor has previously predicted a global offshore wind market of 355GW by 2050, up significantly from the current levels of ~49GW expected to be installed globally by the end of 2019.By Philip Totaro, Founder and CEO, IntelStor, USA

As the industry looks to a bright future, it must also be recognised that within the offshore wind energy supply chain, the market is largely controlled by three major OEMs: Siemens Gamesa Renewable Energy, MHI Vestas Offshore Wind, and GE Renewable Energy.

While Senvion and other Asian manufacturers such as Ming Yang, Goldwind, Shanghai Electric, Guodian United Power, CSIC, Hitachi and Doosan are all engaged in the market, none appear to have the right type of capital structure, or bankable and competitive technology, to engage the global market in a robust way.

The two largest governing influences on the offshore market for the offshore supply chain viability are product bankability and reliability. If we look at the current competing designs in the 10–12MW range, it is important to take note of the pedigree of the companies behind the current generation of products. All have proven to provide bankable technology in the onshore and offshore wind energy markets, and we also take note of the level of investment which has been required in the non-recurring engineering costs involved in order to bring these products to market.

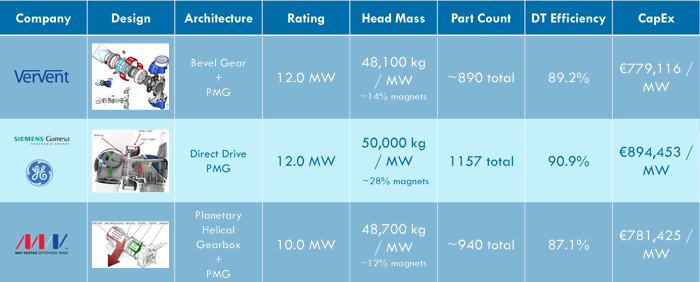

Looking at the scope of the technology, most companies have shifted towards a low speed drive-train with either a direct-drive or 1- to 2-stage gearbox coupled to a permanent magnet generator. By comparison, most other OEMs involved in the offshore wind market all have a comparable design with a smaller order book, implying less economies of scale. Some of these OEMs indeed have fundamentally uncompetitive technology, having scaled up a doubly-fed induction generator and 3-stage gearbox beyond the 5–6MW range. Efficiency losses and a high part count make these designs less desirable in an offshore market environment at power ratings in the 12–16MW range, a market which we are now poised to enter.

Nevertheless, to only have three mainstream OEMs in the offshore wind market is problematic for project developers and financiers as we chase subsidy-free tenders in global markets. The offshore wind energy market has a distinct need for a fourth or even fifth mainstream OEM who presents the market with viable technology and maintains price competition amongst the supply chain, thereby incentivising further cost reductions.

Additionally, any wind turbines which can minimise the rare earth material usage will be preferred looking ahead into the future. This is because of the potential shortages in the availability of rare earth elements used to make the permanent magnets in the generators of offshore turbines due to Chinese supply constrictions in response to trade disputes with the USA. Less availability of raw material implies higher prices, so designs which limit the part count will be highly prized.

Enter Dutch company VerVent, with an offshore wind turbine that is scalable up to 16MW comprising a 1.5-stage bevel-type gearbox and a counter-rotating generator. This design comprises minimal moving parts as well as a limited amount of active material, i.e. permanent magnets which are in use. This means that VerVent can achieve a 16MW power rating with roughly the same composition of magnets as GE Renewable Energy has in its Haliade-X 12MW turbine.

VerVent is founded by Hans Bais and is backed by a team, each of whom has between 30 and 35 years of experience in the wind energy industry. In 2006 the founders of VerVent established Darwind, the 5MW direct-drive wind turbine manufacturer, which was successfully sold off to XEMC of China in 2008.

VerVent’s new design is compelling and noteworthy because it minimises technology and commercial risks by utilising a proven set of supply chain partners including Siemens, Renk, Eolotec, Geislinger and Siempelkamp in an effort to maximise margins and minimise the cost of energy. This is achieved through a drive-train architecture which has been used on other types of high-torque applications in the past and is being adapted for use in wind energy.

Coupled with a stringent testing regime, the VerVent technology can be a market-ready solution in as little as 24 months, which allows this technology to be fully exploited in emerging offshore markets with high growth potential including the USA, Japan, Vietnam, South Korea, Turkey, India, Australia, Azerbaijan and Brazil.

While most mainstream offshore supply chain companies are striving towards higher power ratings above the 10–12MW range, the market can expect more options available in the future.